Thus, a reasonable payment delay allows customers to make additional purchases. The use of credit sales is a key competitive tool in some industries, where longer payment terms can be used to attract additional customers. Credit sales refer to a sale in which the amount owed will be paid at a later date. In other words, credit sales are purchases made by customers who do not render payment in full, in cash, at the time of purchase. In the case of credit sales, the payment may be received by the entity in some days, weeks, or even months so it is recorded as “debtors/accounts receivable” under the head Trade Receivables. Cloud-based software solutions can offer real-time insights into accounts receivable status, enabling quicker decision-making and responses.

Some electronic invoicing platforms also offer functions like automatic payment reminders and real-time payment status updates. The use of current software and technology can enhance efficiency in credit management. Tools like artificial intelligence (AI) can aid in forecasting customer payment tendencies and spot potential defaulters ahead of time. Credit sales, also known as sales on account, are transactions where a business allows its customers to acquire goods or services before making a payment.

This information can be obtained through credit applications and the services of credit rating bureaus. In a cash-tight economy, this is an essential aspect of overall cash management. We’ll now move to a modeling exercise, which you can access by filling out the form below.

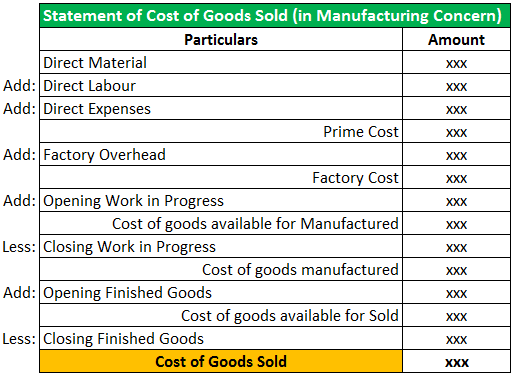

Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling. Technology can markedly simplify the management of credit sales, making the process more streamlined, secure, and user-centric. It is important to learn from past occurrences, stay aware of evolving trends, and adjust credit policies in line with these changes. Net credit sales are used to calculate the Debtor’s turnover ratio, Working capital turnover ratio, and Accounts Receivable turnover ratio. A business model where only cash is the accepted form of payment would, of course, be the most efficient and increase a company’s liquidity (and free cash flow).

This discourse sheds more light on the intricacies of credit sales, elaborating on its core components, potential benefits, and drawbacks, along with some beneficial methods for proficiently managing credit sales. A credit sale is an agreement between a buyer and seller where the buyer can purchase goods or services on credit, meaning the buyer does not have to make payment immediately but rather at a later date. At times the buyer may return goods due to poor quality, inaccurate quantity, untimely delivery, or other reasons. The value of all the goods returned to the entity is added up to arrive at the figure of sales return for a given period. Get instant access to video lessons taught by experienced investment bankers.

In the era of digitization, technology plays a significant role in refining credit transaction management. Proactive actions like the development of an all-encompassing credit policy, carrying out meticulous credit assessments, and implementing potent debt collection strategies can substantially diminish these risks. It is vital for businesses to foster and maintain strong https://www.quick-bookkeeping.net/contribution-margin-ratio-formula-definition-and/ relationships with their clients. Companies should set and agree upon lucid credit terms with their clients to circumvent future misunderstandings and disagreements. Over time, this reinforced relationship could lead to a steady stream of customers and predictable sales patterns. These potential pitfalls underscore the importance of efficient credit management.

What are Credit Sales?

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Credit Sales refer to the revenue earned by a company from its products or services, where the customer paid using credit rather than cash. This form of business transaction is widespread in various industries as it allows for increased flexibility for customers, who are given the opportunity to pay at a later, agreed-upon date. These types of agreements are frequently observed in business-to-business (B2B) operations and contribute to a corporation’s accounts receivable, as noted in its financial reports. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

- While an imperfect measure due to the limited information, one method to approximate the percentage of a company’s revenue in the form of credit is to divide a company’s accounts receivable balance by its revenue.

- The use of current software and technology can enhance efficiency in credit management.

- As previously mentioned, credit sales are sales where the customer is given an extended period to pay.

- Delayed payments allow customers to generate cash with the purchased goods, which is then used to pay back the seller.

- Strategies may include prompt follow-ups on outstanding invoices, engaging professional collection agencies when deemed necessary, and pursuing legal remedies if need be.

However, nuances might arise based on company-specific policies, making it invaluable to consult with accounting professionals periodically. Nevertheless, such a strategy carries inherent risks, including the potential for late payments or non-payments, which could negatively impact the firm’s liquidity and profit margins. Therefore, effective sales management on credit is crucial for businesses to safeguard their interests. Delayed payments allow customers to generate cash with the purchased goods, which is then used to pay back the seller.

What is the formula for net credit sales?

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. No, setting up a credit sale is relatively simple provided that there is an agreement in place detailing the terms of the sale. Thus, the total aggregate downward adjustment to the gross sales made on credit how to start a freelance bookkeeping and payroll service is $4 million, which we’ll subtract from our gross sales of $24 million to arrive at a net amount of $20 million. However, acceptance of credit purchases has become the norm across practically all industries, especially among consumers, as confirmed by the prevalence of credit purchases (i.e. credit cards) in the retail space.

However, like most strategies, offering credit sales does carry inherent risks. The primary risk lies in the possibility of late payments or complete defaults, which can significantly disrupt a company’s cash flow and affect its profitability. Additionally, allowing customers to purchase items on credit can help increase customer satisfaction as buyers can now purchase items with ease. Sales where the buyer’s payment obligation is settled at a later date sometimes after many days, weeks, or months (based on a payment agreement) are called credit sales. For businesses, these steps provide a foundational blueprint for recording credit sales.

If January 1, 2019, Mr. C sold goods worth $1,000, and cash is not received but postponed to Feb.1, 2019.This will be termed credit sales. When goods are sold and cash is not received immediately but postponed to a future date then this is termed as credit sales. While an imperfect measure due to the limited information, one method to approximate the percentage of a company’s revenue in the form of credit is to divide a company’s accounts receivable balance by its revenue. However, while the revenue may be recognized on the current period income statement, the cash component of the payment obligation on the customer’s end has not yet been fulfilled. The gross credit sales metric neglects any reductions from customer returns, discounts, and allowances, whereas net credit sales adjust for all of those factors. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more.

Net Credit Sales Calculation Example

Customers often appreciate the versatility provided by credit sales, enhancing their loyalty and encouraging ongoing business relations. Furthermore, allowing receivable sales might help businesses penetrate new markets and connect with customers inclined towards or needing credit payment options. Regularly monitoring accounts receivable is also crucial to ensure payments are collected promptly and identify potential issues early. Credit sales represent transactions in which goods or services are provided initially, with the promise of payment to happen at a later time. Sellers benefit from an increased ability to sell more expensive items as consumers no longer need to make large upfront payments, while buyers benefit from being able to purchase products now and pay later.

Selling goods or services on credit, which involves deferring customer payments until a later date, can serve as an effective strategy for businesses seeking to expand sales and attract more customers. The average collection period is a metric that measures a company’s efficiency in converting sales on credit into cash on hand. Supervising credit transactions proficiently requires a fine equilibrium between fostering sales, preserving cash flow, and reducing risks. In the world of business, credit sales are an essential component, providing flexibility to customers and fostering business relationships. For instance, IoT-enabled devices in a supply chain can deliver real-time updates on product delivery, leading to automated invoicing and payment procedures. Electronic invoicing lets businesses dispatch digital invoices to customers, accelerating the billing process and minimizing the risk of mistakes.