Though it offers accounting functionality at no cost, Wave isn’t for businesses requiring budgeting, time tracking, job management, and more industry-specific features. Wave’s double-entry accounting system is designed to help you keep track of your cash flow and manage your business finances. With Wave, you can connect your bank account and credit cards, track expenses, and run reports.

However, if you’re after advanced features, like budgeting, projection, and stock management, you’d be better off with FreshBooks or Xero, as these are not offered with Wave. Wave offers competitive accounting software, and is a great choice if you’re running a side hustle and can do without the bells and whistles that come with pricier options. In fact, with quality free packages available, businesses don’t need to spend a dime to get started with Wave — the best value accounting software we’ve reviewed. We like Wave for its ease of use, free features, and low barrier to entry for non-accountants. We also found it cost-effective with unlimited income and expense transactions.

- Instead of establishing a live connection with your bank, you can import QuickBooks Online files, which is very convenient.

- Wave is a double-entry accounting website designed for freelancers, self-employed contractors, and small businesses.

- Accountants get to assign values that reflect sales tax or any tax that the company’s transactions are subjected to.

PCMag.com is a leading authority on technology, delivering lab-based, independent reviews of the latest products and services. Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology. For those looking to ditch physical documents, the software will let you backup your businesses receipts, too.

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. Automate the most time-consuming parts of bookkeeping with the Pro Plan and make tax time suck less. Wave’s invoicing functionality centers on the quick and flexible creation of invoices, which can be customized to suit a business’ white label needs. Being a free app, Wave may be limited to simple accounting processes. If you want an app that is still budget-friendly but can scale to your expected complex requirements in the near future, you can check out FreshBooks.

Wave Accounting Review: App Features, Pricing, Pros & Cons

If you’re getting its paid payroll service, Wave Payroll, you will need to provide your credit card details. An invoice by Wave won’t add tracked hours, won’t display discounts, and doesn’t allow file attachments. This makes Wave ultimately a middle-of-the-road service for invoice creation specifically. It’s not bad at all, but several services are better, with Zoho Invoice in particular coming out ahead – in fact, it supports every feature mentioned here. You can also try out Wave Payroll, a paid service Wave offers for those who want to provide employee payroll through the platform as well. On the other hand, every sole proprietor-appropriate application we’ve reviewed charges for basic accounting.

Wave Accounting Assisted Bookkeeping Options

As far as Wave Payroll is concerned, the service streamlines the payroll process, with the entries syncing with Wave’s accounting platform. This works best for start-ups and small businesses, especially those who have yet to automate their payroll systems. The organization and efficiency imparted by the https://business-accounting.net/ online accounting platform will readily improve the flow of financial information inbound, outbound, and within the company. Since Wave’s accounting, invoice, and receipt tools come at no cost; you can try them out and see how much they improve your accounting workflow compared to using spreadsheets.

Wave Accounting Pricing Packages: What’s Included in the Free Plan?

To recap, Wave can manage invoicing, track expenses, and do bookkeeping. It’s a solid platform for basic accounting needs, but it doesn’t go in for so many advanced features. The vendor also provides expert accounting coaching by real advisors, which is a great resource. It’s hard to beat free accounting software, especially if you’re running a small business on a budget. It also complies with accounting standards, uses double-entry accounting and helps automate the reconciliation process, which can help ensure accuracy and save you time. The main difference between Wave accounting free and paid is that the latter provides access to additional features, such as Wave payroll, payments, and invoicing.

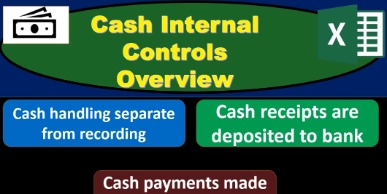

When inviting users, you can give them roles to limit their ability to edit, create, or delete transactions or generate reports. To add more users, go to Settings and click Users under User Management. Wave uses 256-bit transport layer security (TLS) encryption for data security, and all accounting data are stored in servers monitored 24/7. You can access personalized support through the Wave Advisor program where you can get coaching and year-round advice from a Wave expert.

The information presented here may be incomplete or out of date. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. Now, you can go to the Wave accounting sign in page and do your accounting. You will also find that Wave has a different section for your finances, which separate from your business finances. You can have multiple business accounts and toggle between them with a single Wave accounting login.

We recommend Wave for startup and small business owners looking to take financial management from spreadsheets to a semi-automated solution. Wave is a top pick for the accounting and information technology industries, and it’s one of the lower-priced options for its capabilities. Sending and storing receipts are made simple with Wave’s scanner, with the receipts stored in a user’s Wave account. Wave’s receipt scanner isn’t reliant on the internet to function so businesses can scan receipts anytime and anywhere with the use of their mobile devices. Storing scanned receipts isn’t a problem either if there’s no internet, as the receipts are kept under the Wave user’s account, which will then be updated when he goes online.

Wave now uses optical character recognition (OCR) technology to read photos of receipts taken with a smartphone and turn them into categorized transactions. It worked in testing, though the app detects receipts and snaps photos so quickly sometimes that you only get a partial image. You can also create an email-forwarding address so that you can email copies of receipts into your Wave account. However, there are tons of quality options out there, including Zoho Books and Sage, so take a look at our comparison table to discover which piece of accounting software will work best for you. We recommend Wave for small businesses, freelancers, and startups with less than ten employees.

Today’s Wave Accounting offers robust invoicing, accounting, and receipt tracking functionality. It’s a good option to think about if you’re a small business owner looking for free cloud-based accounting software. Indeed, it’s earned a place on our accounting software for small business best of list. However, like most free products, Wave has its limitations, especially compared to more scalable small-business accounting software.

It’s one of the only truly free options on the market and can allow you to manage your accounting processes in one convenient place. Wave isn’t ideal for contractors and other companies needing project management features. You can create and send estimates, but you can’t assign those estimates to individual projects. While it’s easy to use, we encountered several issues with its general features.

Project Accounting

Even if you’ve never used accounting software before, you’ll be able to figure out Wave with ease. There’s also a dedicated invoicing mobile app to keep you going on the go. And further to that point, it’s hard to beat free accounting software with plenty of features, and Wave offers an excellent range of them for freelancers, contractors, and small businesses. We’re beginning to sound like a broken record, but yes, with Wave, you’ll be able to take care of your accounting and bookkeeping for free. That’s worth reiterating over and over, because it’s hard to find functional accounting software tools without ponying up for some recurring payments.

It’s not just for invoices, either, offering general finance management tools as well. As mentioned above, Wave charges for this ability to upload receipts, while other accounting apps don’t. Furthermore, you have to pay this fee for every business you create in Wave. So, it’s hard to make the argument anymore that how much does wave accounting cost the app is truly free for standard accounting features. When you open a transaction to see it, you get more information and can edit its details. You can specify a type (withdrawal, deposit), add sales tax, split the transaction among categories, add customers or vendors, write a note, and upload a receipt.