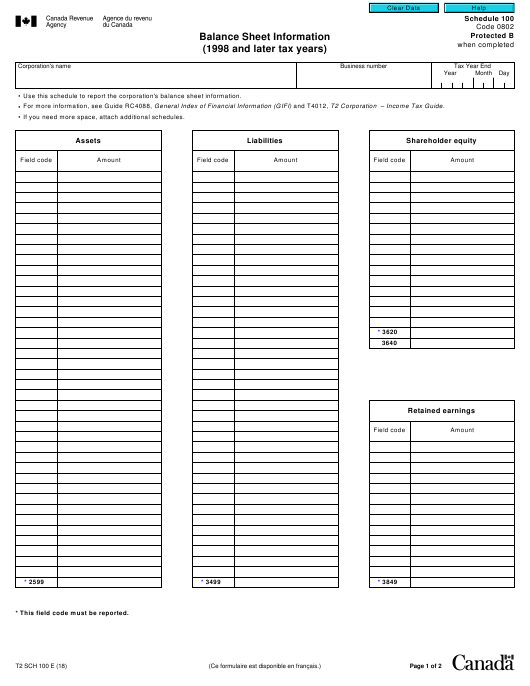

This appeals to people because it translates into one simple, right, suitable straightforward statement – less paperwork. However, it’s essential to keep in mind there is so much more to establishing and maintaining a corporation than the initial decision. For example, you must maintain spotless records and manage a complicated corporation tax refund. Below you’ll find all the advantages and disadvantages of a corporation.

- However, this may also create more administrative burdens and costs for corporations.

- A sole proprietorship provides you with absolutely no protection if someone were to file any sort of lawsuit against your business.

- It actually means ‘the positive and negative aspects of an argument’.

- Incorporation involves drafting “articles of incorporation” which lists the primary purpose of the business and its location, along with the number of shares and class of stock being issued if any.

There are several corporation advantages and disadvantages that must be considered. S corporations combine most of the advantages of C corporations with a better tax structure for the owners. A public company has shares that are available for purchase by the general public (a group of individuals not involved with running the company) or to past employees via stock options. The price at which these stocks are traded is based on supply and demand; therefore, you must make periodic disclosures about your business to make sure investors have enough information to operate. Small businesses usually use the “private” method by having one person or a small group of people with a controlling interest purchase all available stock.

Publicly Held Corporation

Smaller companies can have a single director, while larger ones often have a board comprised of a dozen or more directors. Except in cases of fraud or specific tax statutes, the directors do not have personal liability for the company’s debts. A corporation is a legal entity that is separate and distinct from its owners or stockholders. It is an artificial being, created operation of law, having the right of succession and the powers, attributes, and properties expressly authorized by law or incident to its existence. Since most corporations sell possession through publicly listed shares, they can possibly increase money by selling their shares. This access to money is a privilege that other types of entities do not have.

LLC vs Corporation

Structuring your business as an LLC offers a number of advantages. We follow ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. Much of our research comes from leading organizations disadvantages of corporation in the climate space, such as Project Drawdown and the International Energy Agency (IEA). If it is involuntary, the creditors of an insolvent corporation usually trigger it, and this may lead to the corporation’s bankruptcy.

It doesn’t matter if the corporation doesn’t have enough money in assets for repayment. This eventually makes the company’s ownership easily transferable, which is vital for business continuity and longevity. These people are experts and help you figure out if it is the right legal structure for you.

That includes not having limits placed on non-citizens having a role as an owner. If a corporation distributes profits to stakeholders in the form of dividends, then ownership in a C-corporation is possible for foreign nationals. The only restriction is on S-corp ownership because of the pass-through income stipulation provided for under the current tax laws. A corporation is a great business structure for those who want to create a legal entity separate from themselves as individuals. When you own a corporation, you will be considered a shareholder, and your ownership will be transferable.

Want to start a business?

Some downsides of forming a corporation include the procedure being time-consuming, subjection to double-taxation, and strict protocols to follow. Porter’s Five Forces provides a timeless framework for organizations that want to evaluate their competitive environment, identify opportunities and fortify their positions against threats. By understanding the different forces, businesses can make informed decisions and adapt to evolving markets.

Lenders and creditors, although, have no claim on the assets and personal properties of the owners. This is different from other types of businesses, such as sole proprietorships or some types of partnerships. In case these businesses wind up, the owners are held liable for all the liabilities of the business.

You should also consult with an attorney or accountant who can help you make the right decision based on your specific circumstances. A corporation is a distinct legal entity that offers its owners limited liability in exchange for complying with specific state and federal regulations. In other words, when you form a corporation, your business will have many of the same rights as a person when it comes to things like buying and selling property or defending itself in court. This means that you can protect your personal assets by filing as a corporation or an LLC. While a corporation makes it easier to raise money and transfer ownership, there are a few disadvantages you should consider.

What Is An S-Corp? Choosing The Best Business Structure

In order to establish an LLC, instead of filing Articles of Incorporation like a corporation, LLC founders must file Articles of Organization with whatever state agency manages business registration. Just like a corporation, an LLC must also list a registered agent. These members can still do business, of course; they’ll just have to start a whole new LLC from scratch. A closely held corporation is a corporation whose shares of common stock are owned by relatively few individuals and are generally unavailable to outsiders.

This alone is a benefit worth taking into serious consideration as the key to a successful business is making sure your customers and partners are comfortable doing business with you. What being a successful corporation boils down to is being organized. James Woodruff has been a management consultant to more than 1,000 small businesses. https://accounting-services.net/ As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company’s operational, financial and business management issues. James has been writing business and finance related topics for work.chron, bizfluent.com, smallbusiness.chron.com and e-commerce websites since 2007.

C Corporation

There are many advantages and disadvantages of corporations as a general or as compared to other types of businesses. The most significant advantage of a corporation is the protection a corporation provides to its personal asset liability protection. Making this decision will draw a clear line separating what belongs to you as a business owner and you as a person.