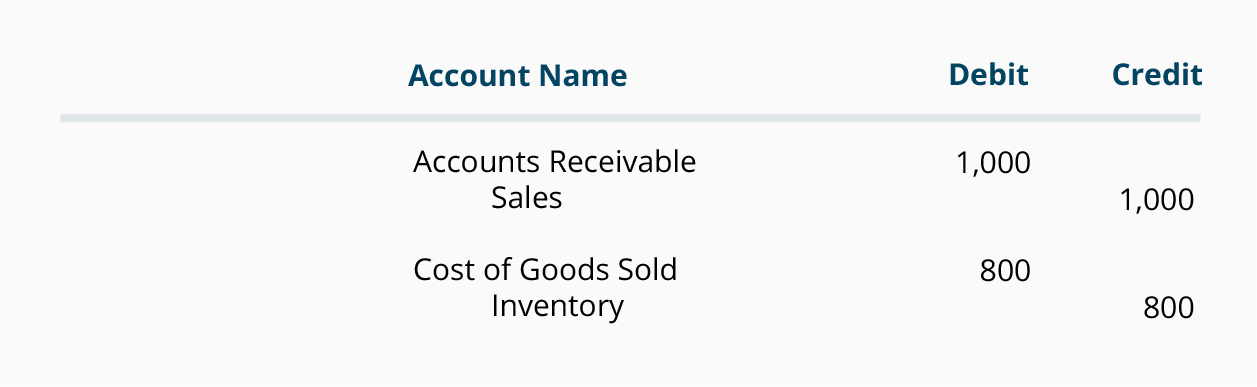

Hence, we need to debit the inventory account as in the journal entry above. For example, on January 31, we makes a $1,500 sale of merchandise inventory in cash to one of our customers. The original cost of merchandise goods was $1,000 in the inventory balance on the balance sheet.

Cost of goods sold on an income statement

Understanding your inventory valuation helps you calculate your cost of goods sold and your business profitability. In a services business, the cost of sales is more likely to be wages, salaries and personnel costs for staff delivering the service, or perhaps subcontracting costs. It might include items such as costs of research, photocopying, and production of presentations and reports.

Cost of goods sold in a service business

Buffer inventory is the inventory kept or purchased for the purpose of meeting future uncertainties. Also known as safety stock, it is the amount of inventory besides the current inventory requirement. The benefit is smooth business flow and customer satisfaction and disadvantage is the carrying cost of inventory. Raw material as buffer stock is kept for achieving nonstop production and finished goods for delivering any size, any type of order by the customer.

Learning Outcomes from Mastering COGS Recording

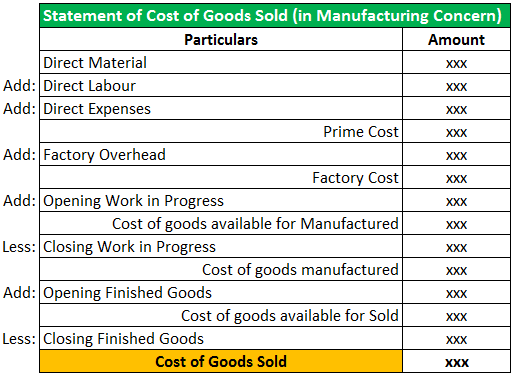

In other words, the total finished goods that were sold was $600. First in, the first out method values inventory at the earliest value of inventory. The cost of goods sold is measured according to the prior inventory purchased rather than the recent one.

Why COGS is crucial for calculating taxable income

The average cost method, or weighted-average method, doesn’t take into consideration price inflation or deflation. Instead, the average price of stocked items, regardless of purchase date, is used to value sold items. Items are then less likely to be influenced by price surges or extreme costs. Due to inflation, the cost to make rings increased before production ended.

- This methodically record-keeping approach ensures that the financial integrity of service-based businesses remains intact for each transaction.

- No matter how COGS is recorded, keep regular records on your COGS calculations.

- Moving onto “The Importance of Recording COGS in Journal Entries,” it’s clear why capturing this information accurately matters for any business.

- When we purchase the inventory, the purchased amount will go directly to the inventory account.

- COGS counts as a business expense and affects how much profit a company makes on its products.

Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Then, the cost to produce its jewellery throughout the year adds to the starting value. These costs could include raw material costs, labour costs, and shipping of jewellery to consumers. To find the COGS, a company must find the value of its inventory at the beginning of the year, which is the value of inventory at the end of the previous year. Poor assessment of your COGS can impact how much tax you’ll pay or overpay.

Thus, they mistakenly assume items that have been stolen have been sold and include their cost in cost of goods sold. Raw materials of all types are initially recorded into an inventory asset account with a debit to the raw materials inventory account and a credit to the accounts payable account. The cost of raw materials on hand as of the balance sheet date appears in the balance sheet as a current asset. You should record the cost of goods sold as a business expense on your income statement. On most income statements, cost of goods sold appears beneath sales revenue and before gross profits. You can determine net income by subtracting expenses (including COGS) from revenues.

With FreshBooks accounting software, you know you’re on the right track to a tidy and efficient ledger. Companies that make and sell products or buy and resell goods must calculate COGS to write off the expense. The resulting information will have an impact on the business tax position. You make this entry every time you sell products, to track how much it costs to produce or buy them. Without precise COGS entries, financial statements might paint a misleading picture of profitability.

Consistent practice using these exercises will not only build your confidence but also deepen your understanding of COGS’ role in business financials. In severe cases, incorrect COGS reporting can lead to legal consequences damage to the business’s reputation. Comparing the two, the main distinction between Cost of Goods Sold and Cost of Service is the type of business in which the cost is applied. Leapfin transforms your messy transaction data into clean journal entries. The cost of goods made or bought adjusts according to changes in inventory.

This figure is key for investors and managers who need to make informed decisions. This means that it reduces your company’s net income, profit, and retained earnings. Debits will increase the balance of your COGS expense account, while credits will decrease it. The COGS is deducted from your business revenue to determine the gross profit, which is then used to calculate taxable income. Since COGS does not account for all operating expenses, the gross profit (revenue minus COGS) might give an inflated view of profitability.

But do you know how to record a cost of goods sold journal entry in your books? Get the 411 on how to record a COGS journal entry in your books (including a few how to record cost of goods sold journal entry how-to examples!). Make sure you accurately classify direct costs, which are traceable to products, versus indirect costs, which are allocated to products.

0 Comments