When sales price changes, per unit variable costs remain the same, but per unit contribution margin changes. This change also affects the total amount for sales dollars, variable costs, and contribution margin. The new total amount is calculated as the new per unit amounts times the sales quantity.

Setting a Dollar Target For Breaking Even

One of the common misconceptions about CVP analysis is that it only works in the short term, which is not true. While it is true that CVP analysis is often used for short-term decision-making, it can also be applied to subject to change long-term strategic planning. Additionally, by conducting a CVP analysis regularly, organizations can proactively anticipate potential changes in market conditions and adjust their business operations accordingly.

Identifying Break Even Point in Cost-Volume-Profit (CVP) Analysis

This is essential for making informed investment decisions, expansion plans, and pricing strategies. By determining the fixed and variable costs in the production process, managers can identify areas where they can cut costs without compromising quality or efficiency. Cost-Volume-Profit (CVP) Analysis is an essential tool for managers to make informed decisions regarding the profitability of their business. Cost-Volume-Profit (CVP) Analysis involves analyzing the relationship between sales volume, costs, and profits to determine the break-even point and assess potential profits. Businesses can use the break-even point to make informed decisions about pricing, product mix, and resource allocation. Fixed costs remain constant regardless of the volume of sales or production.

Cost Volume Profit (CVP) Analysis FAQs

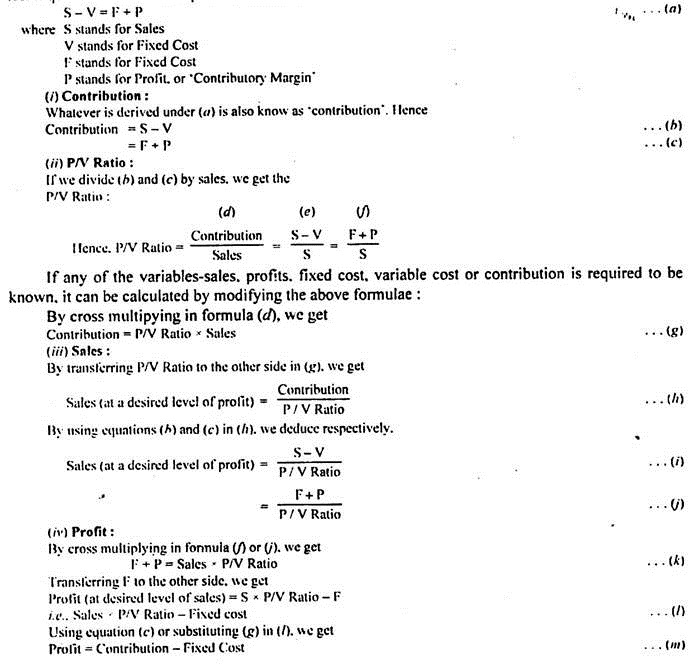

It plays a crucial role in CVP analysis because it affects the revenue generated for every unit sold. Moreover, managers can also use CVP analysis to determine the minimum price point that must be set to cover the costs of producing a product or providing a service. The contribution margin can be used to cover the fixed costs and generate a profit. In this example, the contribution margin of $10,000 can be used to cover the fixed costs of $10,000 and generates zero profit. An organization may use CVP analysis as a planning tool when the management wants to find out the desired profit when the sales volume is known.

17: Cost-Volume-Profit Analysis

Understanding the intricate relationship among cost, volume, and profit is crucial for business success. Any changes in one of these variables can significantly impact the other two, thus affecting the overall financial health of a business. This provides an average contribution per unit sold, and offers a clearer view of overall profitability than looking at individual products. By studying the cost-volume-profit relationships of different products, decision-makers can identify the most profitable products to focus on. Those products that generate higher profit margins for a given volume can be prioritized, thereby shaping the overall product strategy.

- If the store sells $10,000 worth of merchandise in a month, the contribution margin would be zero, and it could not cover its fixed costs.

- Cost-volume-profit (CVP) analysis is a technique used to determine the effects of changes in an organization’s sales volume on its costs, revenue, and profit.

- Managers can use CVP analysis to estimate the sales volume required to break even or achieve specific profit targets.

- The analysis considers the costs incurred during production and the profit margins desired by the company.

- A contribution margin income statement for Kinsley’s Koncepts is provided in Exhibit 4-5.

It helps managers forecast sales and profits using different pricing and volume assumptions. This enables managers to develop more accurate budgets and make informed decisions about investments and capital expenditures. This represents the number of units or products a business sells in a given period. It is a crucial component of CVP analysis because it determines the level of revenue that a company can generate.

In this chapter, cost volume profit analysis using the contribution margin income statement is introduced. Cost volume profit analysis can be used to analyze the effect on net operating income from changes in sales price. A change in sales price is a per unit change, so it affects the per unit amounts on the contribution margin income statement.

CVP analysis is only reliable if costs are fixed within a specified production level. All units produced are assumed to be sold, and all fixed costs must be stable in CVP analysis. Target profit is the point at which net operating income equals a specified amount. Target profit is calculated when an organization needs to know the quantity of sales required to cover total costs and earn a certain net profit. Incorporating CVP analysis into FP&A processes enables financial leaders to manage risk more effectively by understanding the impact of various internal and external factors on profitability. It serves as a foundation for strategic planning, helping businesses to make informed decisions about pricing, cost management, and investment in growth initiatives.

Furthermore, managers can use CVP analysis to calculate contribution margins that reveal how much each product contributes to covering fixed costs and generating profits. CVP analysis provides a crucial framework for analyzing and comprehending the viability of business decisions, pricing, and achieving targeted profits. Examples of variable costs include direct labor, raw materials, and packaging costs. By analyzing variable costs, a business can determine how much it costs to produce and sell each unit. CVP analysis provides organizations with a framework to measure and evaluate their financial performance. To identify patterns and trends, managers can track sales volume, costs, and profitability over time.

Undertaking CVP analysis can initially appear overwhelming, especially for FP&A leaders who are new to the process. In this article, you will learn about CVP analysis and its components, as well as the assumptions and limitations of this method. Additionally, you will learn how to carry out this type of analysis in Google Sheets, so you can easily repeat it periodically.

It conveys to business decision-makers the effects of changes in selling price, costs, and volume on profits (in the short term). The graph above shows the relationship between total revenue and total costs. The area between the two lines below the break-even point represents losses and the area above the breake-even point shows the volume of total profit. High profit levels for a particular product suggest that a business can afford to invest in more efficient production methods or purchase raw materials in bulk, thus potentially reducing costs.

0 Comments